Litecoin to Undergo Block Reward Halving in Just Over 200 Days, First Among Major PoW Cryptocurrencies – Bitcoin News

As an affiliate, we may earn from qualifying purchases. We get commissions for purchases made through links on this website.

Receive $10 in Bitcoin when you buy or sell $100 or more on Coinbase! https://mathisenmarketing.com/coinbase

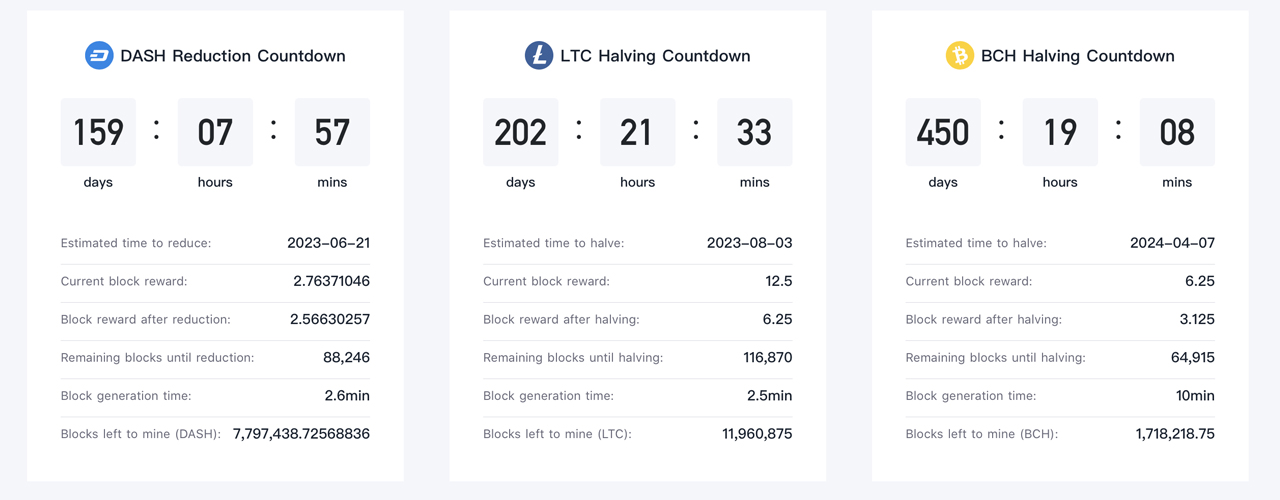

In about 202 days, the cryptocurrency network Litecoin (LTC) will experience a block reward halving on or about August 3, 2023. Litecoin is the first major proof-of-work (PoW) blockchain to reduce its fees ahead of the upcoming launch of Bitcoin. half-life expected to occur after 203 days.

The Litecoin halving will happen on or around August 3, 2023

Litecoin, the 14th largest cryptocurrency today, is preparing to experience a block reward halving in 202 days. It is the first major proof-of-work (PoW) cryptocurrency to have its reward halved, in addition to Dash’s reduction scheduled to take place in 158 days. However, a Dash reduction is different than a halving, as the reward is reduced from 2.763 Dash to 2.566 Dash. Like Bitcoin, Litecoin’s block halving cuts the reward in half (by 50 percent), dropping from 12.5 LTC to 6.25 LTC.

Although litecoin (LTC) has the 14th largest market cap today, it used to be a top 10 cryptocurrency contender in the early days of the crypto market. The LTC network has many differences from Bitcoin (BTC) because there are more coins in circulation – there are currently over 72 million LTC in circulation. However, LTC is close to its maximum supply of 84 million. Bitcoin block time is usually around 10 minutes per block, but LTC blocks are much faster at 2.5 minutes per block.

🔥Litecoin Halving Cycles 2W Chart🔥

Something that gives us a bullish sentiment for the short-term future and a really strong rally from June 2024 onwards.

💡 The next Litecoin halving will take place on August 3, 2023 pic.twitter.com/8tzlCUQICp

— Zen ☮️ (@WiseAnalyze) January 8, 2023

Two-week market statistics show that litecoin (LTC) is up 29% against the US dollar, but LTC is down 79% from an all-time high for the cryptocurrency. LTC hit an all-time high of around $410 per unit over a year ago on May 10, 2021. In addition to the supply gap between LTC and Bitcoin (BTC), Litecoin’s proof of work algorithm, Scrypt, differs by SHA-256. The upcoming LTC halving is Litecoin’s third block reward reduction since its inception.

LTC experienced its first halving on August 25, 2015, and this halving reduced the block reward for miners from 50 LTC to 25 LTC. LTC block halving occurs every 840,000 blocks or four years. The second Litecoin block reward halving took place on August 5, 2019. This particular halving reduced the block reward for miners from 25 LTC to 12.5 LTC, which is the current level of reward for Litecoin miners.

Besides Dash and Litecoin, the next three blockchains to see rewards halved are Bitcoin Cash (BCH) at 450 per day, Bitcoin SV (BSV) at 455 per day, and Bitcoin (BTC) at 474 per day. Ethereum Classic is expected to see a block reduction similar to that of Dash in 568 days. And Zcash (ZEC) will halve in 677 days. When the ZEC block reward is halved, the support will drop from 3.125 ZEC to 1.5625 after the halving occurs on or around November 20, 2024.

What impact do you think the upcoming Litecoin halving will have on its mining ecosystem and price? Leave your thoughts in the comments below.

The authors of the picture: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for information only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or endorsement of any product, service or company. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author shall be liable, directly or indirectly, for any damages or losses caused or alleged to be caused by or in connection with the use of or reliance on the content, goods or services mentioned in this article.

Receive $10 in Bitcoin when you buy or sell $100 or more on Coinbase! https://mathisenmarketing.com/coinbase

Source link